Is economic nexus on your radar?

by: Gail Cole, Writer for Avalara, one of our sponsors

The Supreme Court of the United States recently upended the world of sales tax with its decision in South Dakota v. Wayfair, Inc. (June 21, 2018). Since then, one state after another has adapted its sales tax laws to the post-Wayfair reality. What does this mean for businesses?

It means there’s a whole new way for states to legally impose their sales tax laws on more sellers.

The old way: Tax linked to physical presence

Prior to Wayfair, sales tax was linked to physical presence: A state could require a business to collect and remit sales tax only if it had a physical presence in the state.

The new way: Economic nexus

In South Dakota v. Wayfair, Inc., the Supreme Court found the physical presence rule to be “unsound and incorrect” and overruled it. The case grew out of a challenge to South Dakota’s economic nexus law.

Economic nexus bases sales tax obligations on economic activity in a state rather than physical presence alone. Under South Dakota’s law, a remote seller must collect and remit sales tax if it had more than $100,000 in South Dakota sales, or 200 or more transactions delivered into the state in the current or preceding calendar year. South Dakota will start enforcing economic nexus on November 1, 2018.

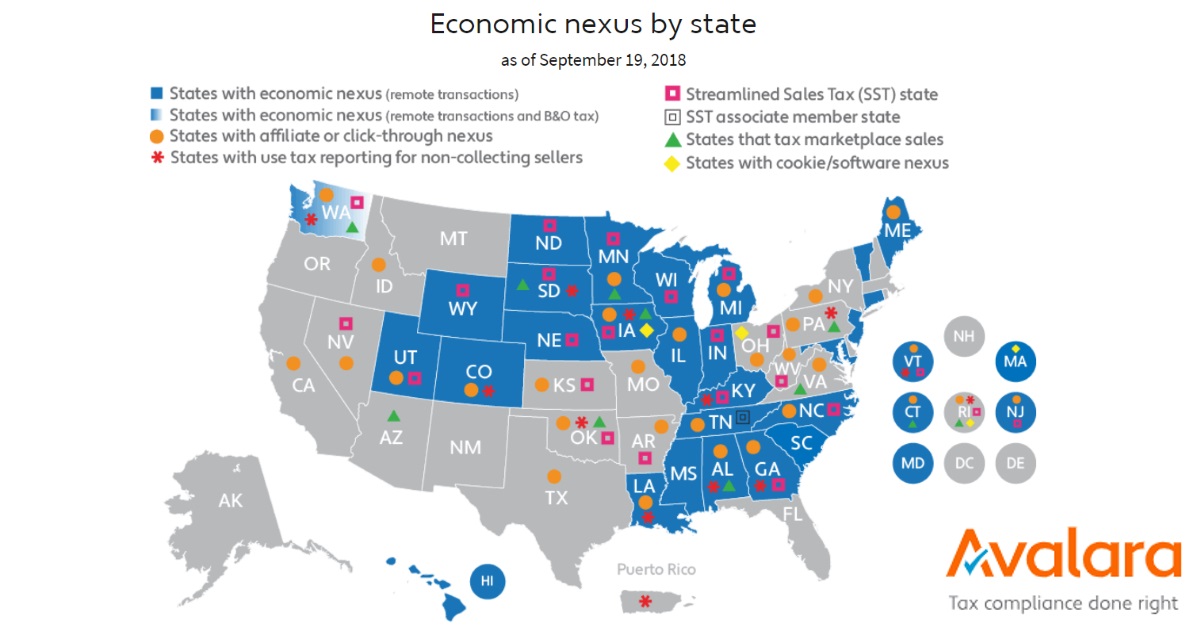

Eager to reap the rewards of this ruling, other states are embracing economic nexus. As of this writing, 27 have done so, and several more have indicated that they intend to, including Kansas, Nevada, and Texas. Economic nexus is already in effect in several states, and it’s taking effect in nearly a dozen more on October 1, 2018.

Impact on businesses

Economic nexus has a real, immediate impact on businesses, many of which are struggling to understand and address new requirements that have emerged in the wake of the Wayfair decision. Anyone making sales, off-line or online, to customers in a state with economic nexus could be on the hook for sales tax.

Here are three steps to take to survive in the post-Wayfair world:

1. Know your nexus

Figure out where you have nexus now, and where it’s looming. This is a moving target because sales tax laws are subject to change in every state, and your responsibilities under those laws can change as your business grows. You can’t just look into this now and then forget about it.

Determining nexus is complicated by the fact that there’s little uniformity between state sales tax laws. While there are certain truisms (e.g., a physical presence in a state still triggers nexus), there are many differences — even physical presence can be defined differently among the states.

This is particularly true with respect to economic nexus. For example: Illinois includes exempt transactions in its economic nexus threshold, but not digital property; Kentucky includes digital property delivered electronically but not services; Hawaii includes tangible personal property, intangible property, and services. The threshold for many states is $100,000 in sales or 200 transactions, but in Alabama it is $250,000, and in Connecticut, it’s $250,000 and 200 or more retail sales.

Businesses currently not meeting the thresholds in economic nexus states need to be vigilant. It’s important to monitor sales in those states so that if economic nexus is triggered, you catch it right away.

2. Register

Once you’ve determined you have nexus, you need to register with the tax authorities and commence collecting, remitting, and filing sales and use tax. Failure to do so could trigger penalties and interest.

Not surprisingly, filing requirements vary from state to state. Keeping on top of your obligations with the additional burden of economic nexus is challenging, especially for businesses relying on in-house staff. Allowing a third-party to take care of sales tax registrations can bring peace of mind.

3. Simplify compliance

Economic nexus is likely to trigger a tax collection obligation for businesses of all sizes in many states. And keeping track of sales tax in multiple states — determining where you have nexus, registering, calculating tax, handling exemptions, monitoring rates, rules, and regulations, filing, and so forth — can be a full-time job.

Fortunately, there’s a government program that may help in some states. Streamlined Sales Tax (SST) will cover the cost of an automated sales tax solution for qualified businesses in any or all of the 24 SST member states, 16 of which have adopted economic nexus.